Impact of Coronavirus in Real Estate Lending

The Coronavirus, also known as COVID19 has shocked the whole world and affected everyone in many ways. Most of the affected countries are on lockdowns and quarantines. Businesses are forced to close, leading to people losing their jobs. Based on the Current Population Survey (CPS) of the Bureau of Labor Statistics (BLS), the national unemployment rate rises to 4.4% as of March 2020. Just last week, the US labor department confirmed that 6.6 million Americans have filed for unemployment benefits. This brings a total of 16 million jobless people. Furthermore, U.S stock markets are declining rapidly while bond prices increase. How about in the real estate industry? What is the impact of Coronavirus in Real Estate Lending?

Undoubtedly, this coronavirus pandemic has put the world economy to a standstill. Even the real estate industry is not exempted. The good thing though is that it doesn’t seem to have a major impact in real estate. Since the coronavirus outbreak, the Federal Reserve carried out two emergency interest rate cuts. The second cut slashed interest rates by half a percentage point. This is the largest one-time cut since the 2008 economic crisis. Moreover, it brings the Treasury bond yields to almost 0 percent. As a result, the interest rates on real estate loans are down.

Impact of Coronavirus in Real Estate Lending

Property Owners Inability to Pay Loans

Rental owners, especially multi-family and commercial owners are crippled by coronavirus. The rise in vacancies and tenants’ ability to pay the rent are the biggest concerns. If persist, it may lead to loss of revenue to the owners. Moreover, their ability to pay their loans will be affected as well. Let’s just hope this will just be a short-term event. If not, it may be even harder for owners to refinance as loans mature.

Demand for Refinancing Rises

More borrowers will consider refinancing and lock in the lowest rates if they continue to stay low. But first, what is refinancing? It is a process where the borrower pays off his existing loan to replace it with a new one. There are lots of reasons why borrowers do this. Some of them aim to:

- Get a lower interest rate

- Shorten mortgage terms

- Consolidate debt

- Change the type of their mortgage

While the lower rates may attract a lot of people to refinance their mortgage, there are pros and cons in doing so. For example, your decision about changing your mortgage length. You may think it is a great advantage for you because it’ll save you money in the long run. But what if you’re not planning to stay in the house for a long time? Therefore, a thorough decision-making process is a must before doing it. The bottom line is, refinancing can be a good financial decision if it lessens your mortgage payment, shortens your loan term, or helps you build equity quickly. It can also be an important tool for managing your debt. Nevertheless, you need to carefully assess your financial situation first.

As a result of the sudden increase in refinancing demands, mortgage lenders have temporarily changed their existing guidelines for mortgage applicants. Just like what JP Morgan Chase did. As of this week, they will require new mortgage applicants a minimum FICO credit score of 700 and they will need to make at least a 20% down payment on the home. This leads to a harder mortgage or even refinancing application.

Liquidity Crisis

Liquidity is a measure of a person or an organization’s capacity of meeting immediate and short-term needs through cash. It can also refer to the assets that can be converted quickly to pay expenses.

The majority of households and businesses are negatively affected by this pandemic. In the United States, 78% of workers live paycheck-to-paycheck while 58.3% are paid hourly. Due to the loss of employment and financial issues, these individuals will likely need assistance from banks to support daily liquidity needs through credit. The increase in the demand has put stress among companies, banks, housing specialty lenders (HSL) and other industries. This pushes them to draw on credit lines to support working capital and stockpile cash.

To better explain, let’s say a homeowner misses his payment. Even so, HSLs still need to remit payments to government agencies. HSLs don’t have deposits, unlike large banks. Consequently, HSLs may face a liquidity crisis because they may need to borrow money from warehouse lenders. These warehouse lenders are usually large financial institutions. If liquidity problems persist, it may lead to capital problems.

Other Financing Options

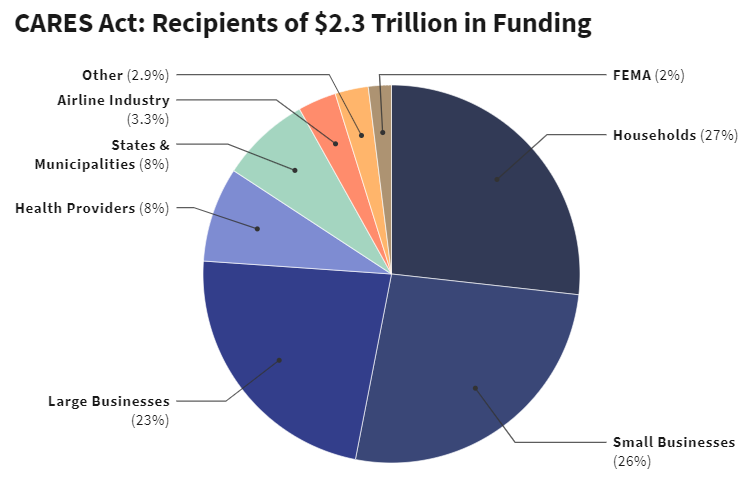

If you are struggling to pay your mortgage during this time, there are other plans you can consider. A month ago, the U.S lawmakers passed a new federal law called the Coronavirus Aid, Relief, and Economic Security (CARES) Act. It is a $2 trillion stimulus bill that aims to revive the U.S economy and as an effort to combat coronavirus.

Here are the recipients of the funding:

Under this new federal law, the CARES Act provides two protections for homeowners and borrowers with federally backed mortgages:

- A foreclosure moratorium

- A right to forbearance for homeowners who are experiencing financial hardship due to the COVID-19 emergency

In case your mortgage is federally backed, you may check other relief options with your mortgage servicer or from your state.

Also, the plan authorizes the Treasury to reactivate the use of the Exchange Stabilization Fund. This is to provide emergency liquidity to money market mutual funds and relax certain capital requirements for banks and credit unions.

Forbearance vs Foreclosure

Forbearance is when the mortgage servicer or lender allows the borrower to pause or reduce your mortgage payments for a limited time. It doesn’t erase what borrowers owe. They still need to repay any missed or reduced payments in the future. Forbearance options for each borrower depend on the kind of loan they have. Meanwhile, a foreclosure moratorium is where the lender takes back the property after the homeowner fails to make required payments on a mortgage. The processes vary by state.

Final Thoughts

And there you have the impact of coronavirus in real estate lending. For now, it may be too early to predict what will happen to the U.S and global economy in the long run. It will depend on how long the virus will last. To better understand whether this is a recession or depression, check Alpesh Parmar’s interview with Richard Duncan. In that podcast, he explains the current condition of the real estate market. On the link, you will find the podcast audio interview along with its transcription.

DISCLAIMER:

THE SECURITIES OFFERED HEREBY INVOLVE A HIGH DEGREE OF RISK AND THEIR PURCHASE SHOULD BE CONSIDERED ONLY BY PERSONS WHO CAN AFFORD TO SUSTAIN A TOTAL LOSS OF THEIR INVESTMENT. THERE IS NO GUARANTEE THAT INVESTMENT OBJECTIVES WILL BE ACHIEVED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE COMPANY PLANNED OPERATIONS HAVE BEEN UNDERTAKEN COMMERCIALLY ONLY BY COMPETITORS ON A LIMITED BASIS AND THERE CAN BE NO ASSURANCE THAT THE BUSINESS PLAN OF THE COMPANY WILL BE COMMERCIALLY VIABLE. IN ADDITION, ACTUAL RESULTS OF OPERATIONS MAY REQUIRE SIGNIFICANT MODIFICATIONS OF ALL OR PART OF SUCH PLAN.

Our intended investments in commercial real estate will be subject to risks relating to the volatility in the value of the underlying real estate, default on underlying income streams, fluctuations in interest rates, and other risks associated with debt, and real estate investments generally. This investment is only suitable for sophisticated investors with a high-risk investment profile. PROSPECTIVE PURCHASERS SHOULD CAREFULLY CONSIDER, AMONG OTHER FACTORS, the section entitled “Risk Factors” contained in the Confidential Private Placement Memorandum of the Company, as may be amended or supplemented from time to time.

DUE TO THE FINANCIAL SOPHISTICATION OF THE PERSONS TO WHOM THIS OFFERING CIRCULAR IS DIRECTED, THIS OFFERING CIRCULAR SETS FORTH LIMITED INFORMATION MATERIAL TO EVALUATING THE MERITS OF AN INVESTMENT. PROSPECTIVE INVESTORS ARE STRONGLY URGED TO CONSULT WITH THEIR OWN ADVISORS PRIOR TO DECIDING WHETHER TO INVEST.

Neither Alpesh Parmar nor Wealth Matters associated claim to be an expert in tax, legal or insurance strategies. Please consult an expert or advisor.