Impact of Coronavirus in Real Estate Investing

In a short span of time, everybody’s lives have changed in many ways due to COVID19, also known as Coronavirus. As part of preventive measures, the government ordered lockdowns and social distancing. People are restricted to go outside and socialize. Some states even have travel and lodging restrictions. Furthermore, the working industry has been greatly affected because of office closures and work-from-home mandates. With the rapid rise of COVID19 cases, things are getting worse. From business shutdowns, layoffs, and quarantines, real estate investors are starting to ask. How does this affect my business? What is the impact of Coronavirus in Real Estate Investing?

Housing Market Overview

Real estate investing has said to be a great investment because it generates steady cash flow but with less risk. However, this has been changed since the outbreak. Real Estate owners, operators, and investors are facing sudden decreased operating income, and tenants struggling to pay the monthly lease.

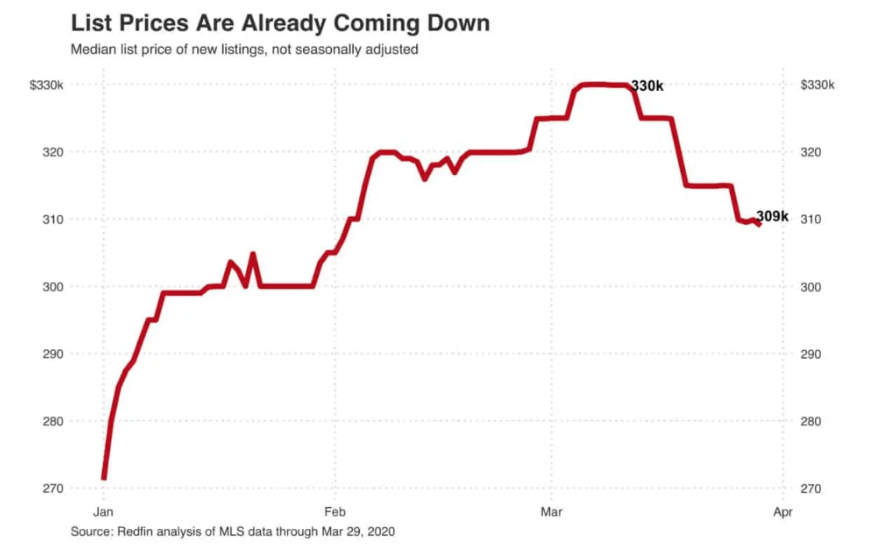

According to data from Redfin, list prices are starting to plunge in the past months. Even prospective home sellers are willing to sell their properties at a lower price. The median price of newly listed homes ending March 29, 2020, dropped to $309,000 or a 6% drop.

Here are the list prices in the U.S. housing market:

The listings for the week ending March 29 fell a whopping 33% compared last year. This indicates that homeowners are losing confidence in the market. With the number of home sales, prices, and supply going down, it won’t be a surprise if people will hold off in buying homes for now.

Impact of Coronavirus in Real Estate Investing

What is the impact of Coronavirus in real estate investing? We will discuss them per sector.

Single-family Residence

Single-family residences built as rental units will benefit from the situation. Right now, offices and companies are transitioning to work from home. But worst-case scenario, the demand, and prices for homes lessen due to furloughs and productivity losses.

Multi-family Residences

Experts say that the impact of coronavirus on multi-family business will be less severe than other sectors. However, this business needs a lot of work than single-family rentals. Landlords/owners of smaller units may need to prepare in dealing with tenants who lost their jobs. Since there are multiple tenants here, I will greatly affect the cash flow. As a result, it may lead to owners asking their lenders for forbearance. To help property owners, the National Apartment Association is asking Congress to give mortgage forbearance to the landlords. Besides, there will be financial assistance for the renters as well. Aside from NAA, the Federal Housing Association is already working to control the impact of coronavirus multifamily property owners.

Now let’s take a look at bigger units like hotels. They probably will not be able to recover lost revenue. Personal travelers postponed their trips following lockdown and quarantine protocols. Moreover, a canceled conference may also be a lost cash flow for hotel operations. But considering a sustained low-interest-rate environment, this could result in a medium-term positive impact on the hotel supply/demand balance. Meanwhile, Airbnb properties will have a hard-hit due travel restriction. Also, the paranoia of the average travelers will be hard to control. They might not feel confident about the cleanliness of somebody’s home compared with the institutional cleanliness of a reputable hotel.

Commercial Real Estate

Commercial real estate covers two sectors of the real estate market: retail and offices. Production and economic activities slow down because people are ordered to stay indoors. Thus, lowering consumer spending. The impact on the retail sector is obvious. Most restaurants and stores are not operating. This results in loss of revenue to the owners too. Meanwhile, in the office sector, most office spaces are empty. The job losses and sudden shift in large corporations’ work environment will hit offices. In fact. big companies like Amazon, Google, and Apple are already taking preventive measures by allowing their employees to work from home.

Self-Storage Facilities

In this industry, the greatest impact will be on shelter-in-place orders from families who live paycheck-to-paycheck. Self-storage tenants may be wondering, “Do I need to continue making storage payments? If I don’t, am I going to incur and accrue late charges? Will I have access to my space? Will the operator sell my stuff? Well, the debate and discussion for the resolution are still everywhere. Some goodwill and positive public relations announced a suspension of late fees. It doesn’t mean they are suspending the lien process, but it can be an option. Meanwhile, the decision of whether they will still allow tenant access despite non-payment is yet to be decided.

Self-storage attorney Jeffrey Greenberger, a partner at Greenberger & Brewer LLP, recommends that operators should actively communicate with tenants who can’t pay rents.

“I have encouraged my clients to work with every tenant who claims some hardship. This can be everything from waiving late fees, splitting up monthly payments into weekly payments, or even deferring some amount of rent as long as the tenant pays some of it,” he says. “That said, we are unfortunately finding folks who simply want to take advantage of this crisis to see what they can get out of all of their creditors. Thus, we are asking for some sort of proof of layoff or cutback in hours as part of our willingness to compromise on full and on-time rent as required by the rental agreement.” Greenberger commented.

In addition, Greenberger advises operators to have tenants sign an acknowledgment that indicates payment compromises are temporary and doesn’t waive prompt repayment once the crisis is over.

Senior Housing Facilities

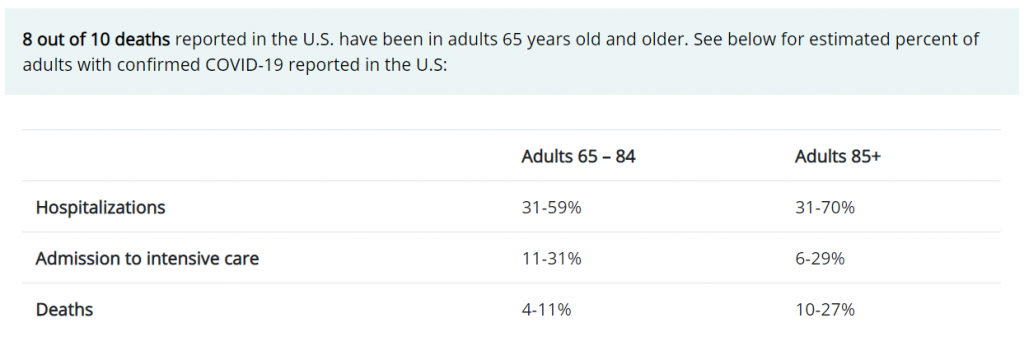

According to the Centers for Disease Control and Prevention, older adults and people who have severe underlying medical conditions like heart or lung disease or diabetes have a higher risk of developing more serious complications from COVID-19 illness. To protect these vulnerable populations, nursing homes and assisted living facilities made some regulations to control the virus from spreading. Some of these are:

- Restrict visitors

- Regularly check healthcare workers and residents for fevers and symptoms, and

- Limit activities within the facility to keep residents safe.

Here’s a report of the estimated percent of adults with confirmed COVID19 in the United States:

DISCLAIMER:

Neither Alpesh Parmar nor Wealth Matters associated claim to be an expert in tax, legal, or insurance strategies. Please consult an expert or advisor.