Impact of Coronavirus on Investors’ Minds

As the number of new confirmed cases rises, Coronavirus (COVID-19) continues to create panic and shatter investment markets. It poses uncertainties about what’s going to happen to the world economy. In the United States alone, there are 1,035,765 confirmed cases already. This is based on Worldometer’s COVID-19 data as of April 20, 2020, 6:23 GMT. Since the COVID-19 confirmed cases escalate rapidly in the United States, home quarantines and lockdown orders are implemented in nearly all states along with closures of school, restaurants, events, and even offices. Given this situation, a recession is inevitable. In this article, we will discuss the impact of coronavirus on investors’ minds.

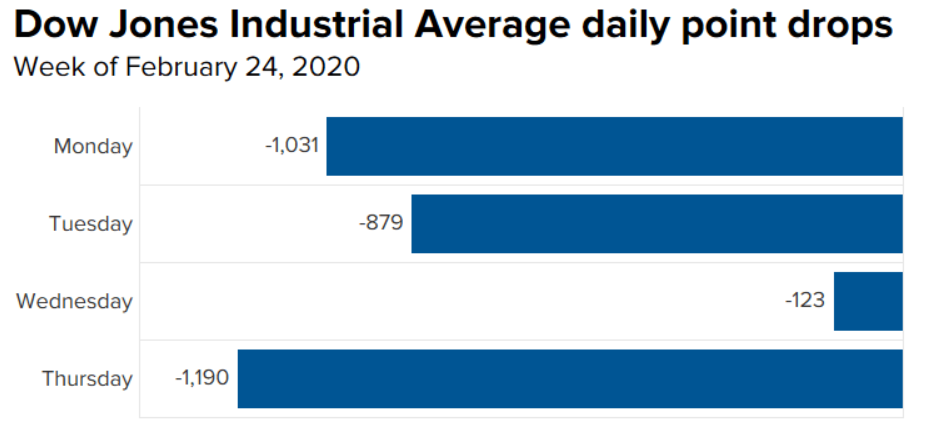

Due to some losses in the financial markets, it is natural for the investors to be concerned with their investments. In the last week of February 2020, the Global markets have lost $6 trillion according to S&P Dow Jones Indices. In the same period, the US stock market suffered a loss of about $4 trillion. This is by far the worst week since the financial crisis in 2008.

In order to limit the economic damage caused by this pandemic, the Federal Reserve has stepped in. One of the first steps they did is cutting the rates down to a range of 0-0.25%. They aim to stimulate economic growth by lowering the cost of interest when borrowing money on auto loans, home equity loans, mortgages, and other loans. As a result, investors and homebuyers can borrow money at a cheaper price. Though lowering interest rates can help restore economic growth, this can’t control the virus from spreading. Besides, there’s little more the Fed can do against a sluggish economy.

Where Does it Leave Investors?

No doubt the coronavirus has greatly impacted our lives. And we still don’t know a lot about it. As of now, the U.S economy still appears to be healthy. But at this point, it’s hard to predict what and how will COVID-19 impacts the economy. Furthermore, the extent of the outbreak is still unknown. Most of the economists expect a loss minimum of 0.1% to 0.5% for the first quarter of 2020. Consumer spending declines due to lockdowns and rising unemployment. This is what investors hate the most – uncertainties.

Due to coronavirus pandemic, some investors opted to get rid of their risky assets and take their highest cash positions. This is according to the Bank of America (BofA) Global Fund Managers survey. Just in April, the average amount of cash balances jumps to 5.9% from 5.1% last March. This is the highest cash balance reported since the September 11, 2011 terror attacks. Furthermore, BofA analysts expect to mark “peak pessimism” with cash balances this month.

It looks like investors are hoarding cash to avert the worst effects of coronavirus. But as an investor, how will you deal with these uncertainties? How to handle the impact of the coronavirus on investors’ minds?

Best Practices to Apply During Crisis

Here are a few steps investors can do to protect their money and investments:

- Establish a Plan – One of the first things you may need to do is to carefully reanalyze your investment/s. Identify your tolerance for risk and goals on each investment. If you think you can’t handle the inconsistencies of that investment, then maybe it’ll be better not to buy or avoid it. Remember in any investment return, there will always be volatility. It’ll just depend on the risk you are willing to take. Focus on your long-term investment goals and stick to your plans. In addition, avoid making any financial decisions that are based on emotional reactions to market inconsistencies.

- Examine Asset Allocation – Asset allocation is an investment strategy that aims to balance risks. This involves dividing assets among different asset categories such as real estate, bonds, cash, and stocks. Most financial experts believe that it is one of the most important financial decisions that investors should make. Each asset class has a different level of returns and risk. Therefore, having asset allocation can help you classify your assets to high and low risk. You need to carefully determine the right mix of your assets. And when you successfully execute that, you may be able to protect your assets against major loss during crises.

- Rebalance your Investment Portfolio – Balance is the key. If needed, try to rebalance your portfolio. It is best if your portfolio has exposure to different areas of the markets – from small to large-caps. Doing this will help you manage the overall risk in your portfolio easier. Thus, helping you survive these uncertainties.

- Seek Professional Advice – Sometimes, emotions get in our way especially when you’re too invested in your finances. Therefore, meeting with a financial advisor may be a good idea during these tough times. An advisor can help you set your goals and avoid making emotionally driven decisions. He can also help you build an investment portfolio that aligns your tolerance risk and meet your goals. Volatility and risk may be impossible to avoid, but their impact on your investment is manageable.

What Can We Expect?

As of now, the coronavirus outbreak continues to spread. It still creates fear and disrupts economic activities. Are we going to experience the 2008 financial crisis again? Or it is going to be different this time? Well, there’s no definite answer yet. It is still too early to tell. The only thing we have control of is the impact of coronavirus on investors’ minds

DISCLAIMER:

THE SECURITIES OFFERED HEREBY INVOLVE A HIGH DEGREE OF RISK AND THEIR PURCHASE SHOULD BE CONSIDERED ONLY BY PERSONS WHO CAN AFFORD TO SUSTAIN A TOTAL LOSS OF THEIR INVESTMENT. THE ACHIEVEMENT OF INVESTMENT OBJECTIVE IS NOT GUARANTEED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE COMPANY PLANNED OPERATIONS HAVE BEEN UNDERTAKEN COMMERCIALLY ONLY BY COMPETITORS ON A LIMITED BASIS. THERE CAN BE NO ASSURANCE THAT THE BUSINESS PLAN OF THE COMPANY WILL BE COMMERCIALLY VIABLE. IN ADDITION, ACTUAL RESULTS OF OPERATIONS MAY REQUIRE SIGNIFICANT MODIFICATIONS OF ALL OR PART OF SUCH PLAN.

Neither Alpesh Parmar nor Wealth Matters associated claim to be an expert in tax, legal, or insurance strategies. Please consult an expert or advisor.