How to Start with Buy and Hold Residential Real Estate

Real estate is said to be a good investment for many reasons. One of them is its flexibility. Unlike other types of investments, it has many different methods that investors can explore. This what makes real estate perfect as a good career path, whether part-time or full time. Every investor’s goals are short-term profit and long-term appreciation. In this article, we will discuss how to attain both through buy and hold real estate investment.

What is Buy and Hold Real Estate?

Oftentimes, experts will say it is good to diversify your real estate portfolio. Investing in buy-and-hold real estate is one of the best ways to do it. Buy-and-hold is a real estate investment strategy where investors buy investment properties and hold them for a long time. Typically, they hold onto the properties for five years or more. In other words, they do it not just to buy, renovate, and immediately sell it. They’re holding them to leverage the property’s long-term appreciation. The buy-and-hold real estate is considered as one of the most common real estate investment strategies used by investors.

How Do Investors Benefit from Buy and Hold Real Estate?

Buying rental properties for long-term purposes can bring multiple benefits to the owner. While the property is “on hold”, investors use it as a rental property to generate income. This is where the return of investment takes place. If done correctly, investors generate positive cash flow (through rent payments from tenants) while enjoying long-term real estate appreciation.

If you’re a first-time investor, this strategy may be perfect because it is one of the easiest strategies to learn and do, compare with others. Some strategies need expertise and years of experience to properly do them. Professional property investors prefer this strategy more because it helps them build wealth gradually through equity buildup and property appreciation. So, if you’re looking for long-term investment and long-term goals, you may want to consider the buy and hold strategy.

Types of Buy and Hold Real Estate

Now that you already get the idea of how buy-and-hold investing strategy works, it’s time to identify the property type you want to invest in. Here are different types of residential properties where you can use buy and hold strategy:

- Turnkey Real Estate – Turnkey real estate is a “move-in ready” property. Usually, it comes with tenants and professional property management. Everything is provided and taken care of. You just need to “turn the key” and you’re good to go.

- Vacation Rental Property – If you choose the right property correctly, investing in vacation properties can be good because it neutralizes the cost of homeownership through rental income.

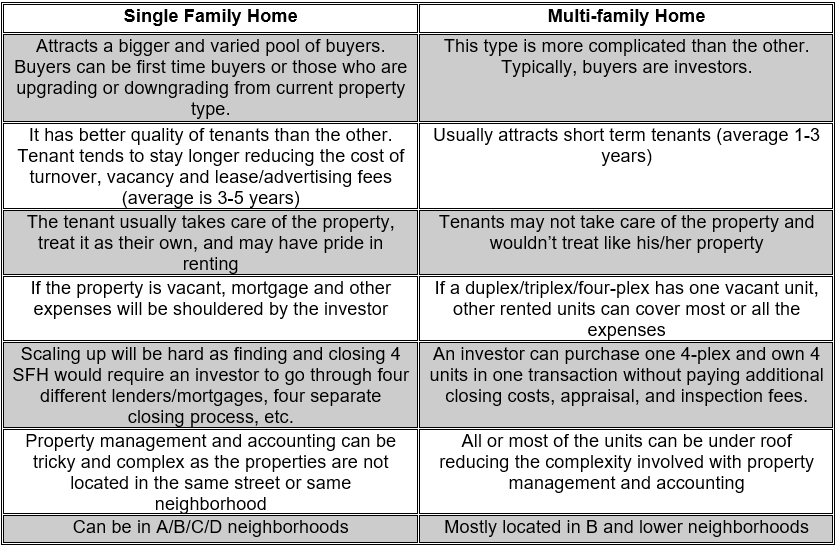

- Single-family Home – This is the typical type of property used for long-term rental strategies. A lot of beginners also use this as a steppingstone in real estate investing. You’ll simply buy and invest in a single-family house and rent it to a tenant/family. Less tenant to deal with, fewer complications.

- Multi-family Home – If you are the type who wants more units, a multi-family property may be the perfect choice for you. It is a property with multiple housing units (usually 2-4 units). The multi-family home creates a stronger cash flow than a single-family home because you’re housing multiple tenants. Thus, giving you a higher rental income.

To fully understand the difference between single-family and multi-family home, check the table below:

Benefits of Buy and Hold Real Estate Investing Strategy

Rental Income

This is usually the primary reason why property investors do this strategy. Whatever property type you invest in, buy and hold strategy may give you passive income. For bigger units, you can hire a professional property manager that can take care of everything for you.

Tax Advantages

There are several tax advantages you can enjoy when you have rental properties. Aside from property tax benefits, you can also write off some expenses like depreciation, mortgage interest, and loan origination fees. Maintenance, repairs, and other operating expenses are also tax-deductible.

Equity

One of the things to deal with if you own property through a bank is the mortgage. If you have rental properties. You don’t have to worry about that anymore. With rental payments, the tenants are the ones paying your mortgage. They may also cover other expenses. As monthly rent payments cover mortgage payments, the equity of your property increases monthly. Therefore, you need to find good tenants that pay rents on time.

Property Appreciation

It’s a no-brainer that real estate markets can fluctuate over a long time. The key is to find a good location and a good market. With the right market, your buy and hold investment properties can steadily gain value. The typical annual appreciation rate of buy-and-hold properties is between 3 and 5 percent.

DISCLAIMER:

THE SECURITIES OFFERED HEREBY INVOLVE A HIGH DEGREE OF RISK AND THEIR PURCHASE SHOULD BE CONSIDERED ONLY BY PERSONS WHO CAN AFFORD TO SUSTAIN A TOTAL LOSS OF THEIR INVESTMENT. THERE IS NO GUARANTEE THAT INVESTMENT OBJECTIVES WILL BE ACHIEVED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE COMPANY PLANNED OPERATIONS HAVE BEEN UNDERTAKEN COMMERCIALLY ONLY BY COMPETITORS ON A LIMITED BASIS AND THERE CAN BE NO ASSURANCE THAT THE BUSINESS PLAN OF THE COMPANY WILL BE COMMERCIALLY VIABLE. IN ADDITION, ACTUAL RESULTS OF OPERATIONS MAY REQUIRE SIGNIFICANT MODIFICATIONS OF ALL OR PART OF SUCH PLAN.

DUE TO THE FINANCIAL SOPHISTICATION OF THE PERSONS TO WHOM, THIS OFFERING CIRCULAR IS DIRECTED. THIS OFFERING CIRCULAR SETS FORTH LIMITED INFORMATION MATERIAL TO EVALUATING THE MERITS OF AN INVESTMENT. WE STRONGLY URGE PROSPECTIVE INVESTORS TO CONSULT WITH THEIR OWN ADVISORS PRIOR TO DECIDING WHETHER TO INVEST.

Neither Alpesh Parmar nor Wealth Matters associated claim to be an expert in tax, legal, or insurance strategies. Please consult an expert or advisor.