How to Flip a Property: Tips and Guide

There are several ways of making a profit in real estate. And most of the time, they will teach you the gradual and stable ways of building wealth. But what if you need a one-time big-time profit? Would it be possible? The answer is simple — of course, it is! That’s the beauty of the real estate. It’s ideal for both short and long-term financial goals. Today, we will discuss an investment strategy where you can get an instant profit: Flipping a property. After reading those words, these questions might come up in your mind: what is house flipping? How to flip a property?

What is House Flipping?

House or Property flipping is an investment strategy where a real estate investor buys a house and quickly resells it at a higher price to earn a profit. Since you are reselling it at a higher price, it gives you an immediate lump sum profit. The time between buying and reselling the house depends on the investor’s decision but typically, it ranges from a couple of months to a year.

There are two different ways of flipping a house/property.

- An investor buys a property then works on repairs and refurbishes the property. After completing the necessary works, he sells it for a higher price than the purchase price.

- An investor purchases a property in a hot market where home values rise rapidly. He didn’t make any updates or repairs, but rather hold on to it for a few months. When the right time comes, he resells it at a higher price and earns a profit.

Flipping is not limited to refurbishing the property. You can renovate the property, but it doesn’t need to be always involved. The term “flipping” may apply even if you don’t do any work as long as you have the intention of reselling it quickly. Oftentimes, flipping is also referred to as the “buy-to-sell” process.

Sounds Like a Good Investment! Is It for Me?

If we will base it from the description above, the process on how to flip a property seems simple and easy. But it’s not. Flipping a property can be either a dream or a nightmare. When done correctly, you can make good money out of it. But you can also lose everything if you did it the wrong way.

Now that you know the ways to make money from flipping a house, let’s discuss how to calculate your return on investment (ROI) on a certain property. In this way, you can estimate your potential earnings and determine if it’s a good deal or not.

The calculation is simple: Profit / Cash Invested – ROI

For example, you bought a property for $100,000, made necessary repairs for $15,000 and sold it for $150,000. Let’s do the math: $100,000 + $15,000 – $150,000 = $35,000. Therefore, your profit from that deal is $35,000.

Now let’s do the ROI calculation with the example I gave:

$35,000/$115,00 = 0.30

This means your ROI in this deal is 30%. What is considered a good ROI for a flip? Well, a good ROI is whatever you’re satisfied with. But typically, investors use a 20% ROI. For easier ROI calculation, you may use this free ROI calculator.

4 Important Things to Keep in Mind When Flipping a Property

How to be successful in flipping? The key involves finding the right property and opportunity, financing it wisely, getting the numbers right, and executing it carefully. This article will be your guide on how to flip a property correctly.

Pay a House Flip Using Cash

When flipping a house, the goal is to earn money not to add debt to your finances. Doing so can put a great risk to your investment. Therefore, it is ideal to always flip a house with cash.

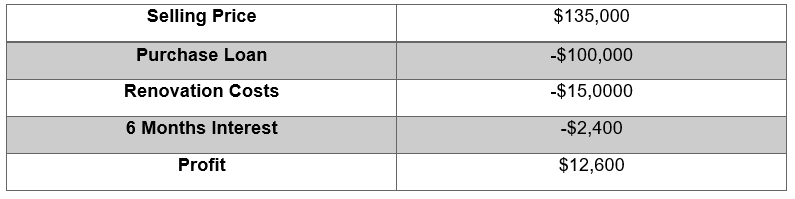

Let’s use the same example given above to understand why flipping a house using debt isn’t worth it. Supposing you take a loan with (0.4% interest) to buy the flip house for $100,000. Then you finance the $15,000 for 6 months renovation and anticipates selling the property for $150,000. Now you list the house but didn’t expect it to sit on the market for too long. Out of desperation, you are forced to lower the selling price to $135,000.

Here’s the breakdown:

Applying the ROI calculation, $12,600 / $117,400 = 0.1073%

For a 6-month work, do you think 11% ROI is worth it? Clearly, not because you barely made any money on this project. The example above doesn’t even include other fees like closing costs, (which usually run from 5%-8%) taxes, and agent commission. If the flipper is a realtor, he wouldn’t have to pay for the seller agent’s commission.

If you’re aiming for 20%-30% profit, the purchase price including repairs should be at 70% of the After Repair Value (ARV).

Set a Budget for House Flip and Renovations

Before you seal a deal, it’s important to always set a price range for your purchasing price, renovations, and selling costs. It’ll help you give an idea of how much profit you can make on the deal. Moreover, it also good to ask help from experts so you will know what and how much the fixes would be. You wouldn’t want surprise repairs along the way as they’ll be additional costs for you. It’s good to spot problems beforehand than to be surprised at the end of the road.

When you know your budget upfront, you’ll learn how to invest in smart renovations. You’ll know if a big renovation would be a smart move or not. When renovating, try to spend less as much as possible so the possibility of earning back your costs will be higher.

Study the Market

Another factor that plays an important role in the success of your flipping is your knowledge of the local real estate market and trends. Having a deep understanding of the market can’t be done overnight. You’ll need to find the best real estate agent with years of expertise in the area where you want to flip. Your agent has access to extensive records that can help you find the right property in the right location based on your price range, budget for renovations, and your desired profit. The agent will help you price the house competitively so you can get the best and right amount for the house.

Seek Assistance from the Experts

Learning how to flip property can be difficult especially for first timers. The key is to educate yourself. Do your homework and perform research to avoid mistakes. You can also ask advice from experienced house flippers and other real estate experts. Learn from their mistakes so you can avoid making them your own. Other professionals like lenders, contractors, and home inspectors can also help you in making smart renovations.

Building a professional network is necessary in flipping homes.

DISCLAIMER:

THE SECURITIES OFFERED HEREBY INVOLVE A HIGH DEGREE OF RISK AND THEIR PURCHASE SHOULD BE CONSIDERED ONLY BY PERSONS WHO CAN AFFORD TO SUSTAIN A TOTAL LOSS OF THEIR INVESTMENT. THERE IS NO GUARANTEE THAT INVESTMENT OBJECTIVES WILL BE ACHIEVED. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE COMPANY PLANNED OPERATIONS HAVE BEEN UNDERTAKEN COMMERCIALLY ONLY BY COMPETITORS ON A LIMITED BASIS AND THERE CAN BE NO ASSURANCE THAT THE BUSINESS PLAN OF THE COMPANY WILL BE COMMERCIALLY VIABLE. IN ADDITION, ACTUAL RESULTS OF OPERATIONS MAY REQUIRE SIGNIFICANT MODIFICATIONS OF ALL OR PART OF SUCH PLAN.

DUE TO THE FINANCIAL SOPHISTICATION OF THE PERSONS TO WHOM, THIS OFFERING CIRCULAR IS DIRECTED. THIS OFFERING CIRCULAR SETS FORTH LIMITED INFORMATION MATERIAL TO EVALUATING THE MERITS OF AN INVESTMENT. WE STRONGLY URGE PROSPECTIVE INVESTORS TO CONSULT WITH THEIR OWN ADVISORS PRIOR TO DECIDING WHETHER TO INVEST.

Neither Alpesh Parmar nor Wealth Matters associated claim to be an expert in tax, legal, or insurance strategies. Please consult an expert or advisor on how to flip a property.