Real Estate vs Stock Market: Which Investment is Better?

If you are looking to build your wealth, you probably heard of the real estate and stock market. You may be thinking, which of the two is a better investment? Invest in real estate or invest in the stock market? If you are to decide which venture to invest in, the choice cannot be answered quickly. Unless you already did your research or an experienced investor. In deciding the better choice, you need to identify your preferences, goals, needs, risk tolerance, and many more. Hence, it is clever to know the difference between the two. This includes both of their advantages and disadvantages. Read further to learn more about the real estate vs stock market.

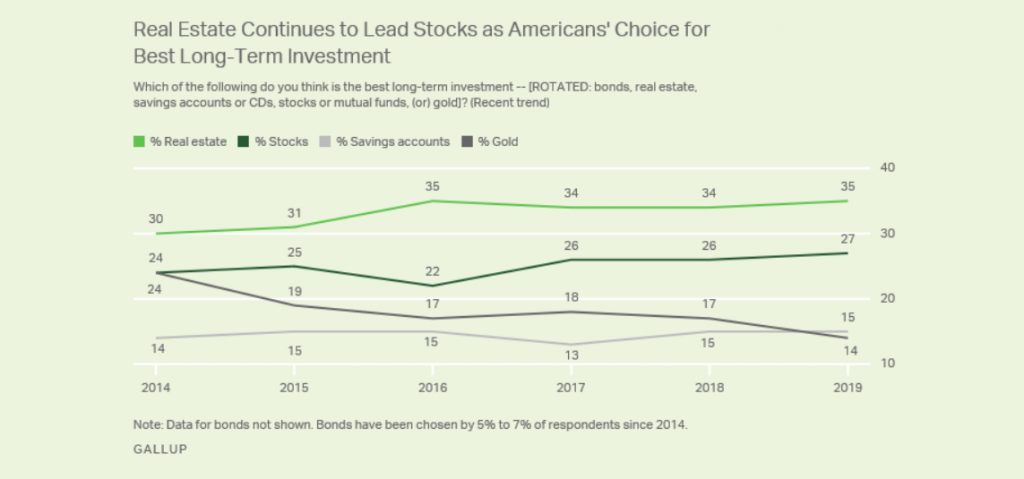

Real Estate vs Stock Market: Which Investment Do People Prefer More?

Let us look at the data:

According to the 2019 Gallup poll, 52% of Americans own stocks. Meanwhile, 63% of Americans own real estate according to the Census Bureau. In addition, Gallup also conducted a poll to ask Americans which investment venture they think is the best long-term investment. The result shows that 35% of Americans continue to believe that real estate is a better long-term investment than stocks and other investment options. Only 27% of Americans prefer stocks over real estate.

But considering the economic shock caused by the coronavirus, Americans lost more confidence in the stock market. According to Gallup’s annual Economy and Finance survey conducted last April 1-14, 2019, the data went down from 27% to 21%. 1,017 U.S adults participated in the said survey.

Real Estate vs Stock Market: How to Invest?

Investing in real estate may involve buying physical land or property. It has two main categories based on purpose: residential and commercial properties. Residential properties include residential homes, rental properties, flipping properties. While the latter include apartment complexes, office, and retail spaces, and strip malls. There are several ways on how to invest in real estate.

On the other hand, when you invest in stock markets, you are buying a share of the company. For instance, the company has 1,000,000 shares outstanding. Then you decided to buy 10,000 shares. This means you own 1% of the company. Once the value of the company’s shares grows, the value of your stock also grows. Typically, the company’s board directors watch over the management, decide the reinvestment of the profit, and how much gets paid out as cash dividends. The board of directors is usually elected by stockholders (just like you).

Real Estate vs Stock Market: The Pros and Cons

The Pros and Cons of Investing in Real Estate

The Pros

Security and Safety

Generally, owning real estate is considered a hedge against inflation. This is because the home values and rents typically increase during inflation. Besides, it is safer to invest in real estate using debt (mortgage). You can use your mortgage in investing a new property with a low down payment. Meanwhile, investing in stocks with debt (margin trading) is extremely risky. It is also not advisable to first-time traders.

Easier to Comprehend

The process of buying a property can be complicated. However, the general rule for creating a profit is simple. Buy a property, manage it (for rental) or fix it up (flipping) then resell it for a higher value. For rental properties, the passive income from monthly rental is easy to manage. Aside from that, owning real estate can make you feel more in control of your investment than buying shares of stocks. This is because it is a tangible asset than you can physically visit and inspect.

Steady Cash Flow

The monthly rental income you can get from rental property provides stable and reliable cash flow. Therefore, invest in real estate if your goal is to have a positive cash flow monthly.

Tax Advantages

Investors enjoy several tax advantages. The main tax benefit of having a rental property is that the monthly rental income is non-taxable. Though the income is not taxed, investors can deduct mortgage interest, property tax payments, and other expenses from their federal taxable income. This is if they itemized their deductions. Additionally, investors can exclude (up to a certain limit) the capital gain from a home sale. You can check the other investor’s tax benefits here.

Real Asset

Real Estate is a tangible asset that you can see and enjoy. Besides, it will always be on-demand. People will always need housing. The land will always have value tied to it and won’t go to zero.

The Cons

Time and Effort

Real estate requires more attention and work than stocks. The work does not end in buying the property and renting it. Maintaining and managing a rental property can be demanding. You must deal with phone calls about the sewage problem in the bathroom, screening tenants, and filling in vacancies. What more if you own 2 or more rental properties? Others might say that hiring a property manager will resolve this problem. While this may be true, managing your investment will still require oversights and meetings.

Higher Costs

Real estate is a large upfront investment. Whether you are to buy, sell, or rent the property. Even if you are to borrow cash, you will still need to pay a hefty amount upfront. While if you are to sell a property, a seller must pay closing costs that are usually between 6%-10% of the sale price. Real estate can also cost you money monthly if you have vacancies. Even though the property is vacant, the costs you are paying like insurance, utilities, insurance, continues. Hence, you can end up losing money if your vacancy rate is high.

Illiquidity

The value of your real estate investment can be hard to determine at any time, unlike stocks. Also, if you are to sell your property it may take weeks, months, or even years (worst case scenario) before you can find a buyer.

The Pros and Cons of Investing in the Stock Market

The Pros

Minimal Work and Effort

Unlike real estate, owning shares of stocks does not require any effort from you. You can watch your money grow just by watching the company’s result. You benefit from the company result. But the company owner/ board of directors will not require you to show up to work.

Affordability

If you want to invest in the stock market, you do not need to cash up a huge amount of money. Through mutual funds or individual stocks, you can invest as low as $100 per month. There are also micro saving apps available that help prospect investors invest for less than $25.

Liquidity

When it comes to liquidity, stocks work better than real estate. At any time you decide to sell your shares, you can do so. It can be done as soon as you decide to act. Unlike real estate, you need a lot of preparation before selling a property. Besides, the selling process can take a long time.

Dividends

There are high chances that you receive a bigger profit as the company grows. Although it still depends on the company’s performance. High-quality stocks increase profits yearly. When that happens, cash dividends increase as well.

The Cons

Volatility

The price and value of stocks can change in the blink of an eye. In fact, it moves up and down faster than real estate prices.

Prone to Emotional Decision-Making

Due to volatility, investors often worry and want to secure their investment. As a result, they are prone to decide based on emotions once they panic.

Stagnation

The growth of the company plays an important role in stock investing. You would want to invest in companies that have big growth potential. If not, your investment will be stagnant and stuck at low value.

Paper Asset

Stocks are an intangible asset that you can not see or control. If the business goes under or files bankruptcy, the value of your stock can become zero.

DISCLAIMER:

Neither Alpesh Parmar nor Wealth Matters associated claim to be an expert in tax, legal, or insurance strategies. Please consult an expert or advisor.