What is Bitcoin and why you should look into it?

“Should I invest in cryptocurrencies?” This is the question I hear from friends and investors. My answer is if you have stomach to lose everything, absolutely YES.

Bitcoin is one of several cryptocurrencies which were invented to act as a means of exchange like traditional currencies, but outside the realm of governments and traditional banks.

Why do people have faith in bitcoin?

The technology sounds complicated. But before money was used, trade was complicated too. People bartered, using an exchange system that was tediously based upon needs, demands, wants, and willingness to trade goods and services, directly complicating things. It also relied on the physical proximity of the people and goods.

Imagine, I have wheat but want onions. But the guy with onions wants eggplant. The lady with eggpant wants wheat. If we all happen to be at the same place at the same time, no issue. We trade. But if I’m late to market one day, then no one gets what they need and want because the trade can’t happen. “Money” is the way to make these transactions simpler, more efficient, and accessible by buyers and sellers all the time.

As a widely accepted medium of trade, the use of money (or currency) grew quickly, especially for city-states and nations involved in a trade. It was easy to use and allowed great flexibility in the marketplace. This growth made a need for standardization and regulation. Notes could easily be counterfeited and there was no official system of registration in place.

So what?

Therefore banks were established to organize the financial needs of each nation, by deterring double transactions, counterfeiting, or false registrations. They provided a level of trust for the system, and as long as that trust held, the monetary system flourished. In the U.S., we still use a national central server which keeps records about all the balances of all the U.S. currency in use daily throughout the world. It’s the Fed, and all funds must balance every day.

The needed standardization of money is what fostered cryptocurrency in the global economy. The internet has its roots in decentralized design, just like cryptocurrency. Before the internet existed, we had “Usenet” as a first global online community. Anyone could create and run their own server, connect with different computers through dial-up, and start receiving/sending messages.

No one controlled Usenet, which in theory explains the birth of a decentralized system. But standardization and centralization are not synonymous. It is possible to have standardization without centralization…just uncommon. The UNIX standard is a great example. The internet is global and, therefore, a standard for digital money was created and is the value of exchange located on the worldwide web.

Blockchain Explained

The word “blockchain” is used a lot in the description of Bitcoin and explains why it is safe and secure. Basically a blockchain is a digital ledger for everything of virtual value. A better way to see it is to imagine using a spreadsheet that is multiplied thousands of times across the web of computers logged into the network and regularly automatically updates all data. The P2P network is blockchain driven. As the user transacts over the network, there’s a new creation of a “block” in the chain of transactions throughout the system.

Money in the United States, up until the 1970s, was backed by gold held by the U.S. government in Fort Knox and big vaults under New York City. As of today, 4.46% of U.S. dollars in circulation are “backed” by gold, the rest backed by promises and goodwill.

The purchasing power of the U.S. dollar has been on a serious decline since the gold standard was removed by Nixon in 1971. But to be fair, the number of dollars people earn to purchase goods has gone up too. A teacher’s salary was $8,600 in 1971. Today it’s $54,700. So, if the value of the dollar has fallen by 80%, and the salary has risen by 6 times, the difference is not as great as it might appear without seeing the two side-by-side.

With Microsoft, Dell and lots other companies starting to accept bitcoins, to function and use bitcoins require an online wallet. An online wallet is a database which holds the bitcoins on your phone, computer, or tablet. There are several mobile applications that allow you to download and use as a wallet. Some of the applications for making payments using bitcoins are BitPay and Bitcoin Checkout.

Alternative Way of Getting Bitcoin

Another alternative to getting bitcoins is through what is known as bitcoin mining. According to bitcoin.org, the “mining” consists of solving mathematical problems in exchange for bitcoins. Mining is crucial, as miners use their computers to approve bitcoin transactions and keep the bitcoin network secure. Anyone can become a miner, but they must have specialized software and hardware. The miners are a group of people who are engaged in processing transactions and, in exchange for this work, they receive bitcoin. But that amount is regulated by mathematical formulas and is limited, so as to expand the supply only minimally.

What next?

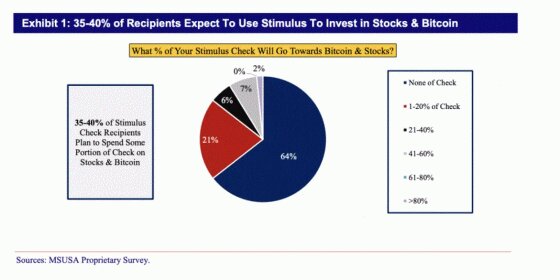

A poll by Mizuho Securities found that two in five stimulus check recipients plan to invest at least some part in Bitcoin or stocks. About 10% of the total gross payment or $40 Billion could go into stocks and Bitcoin. Survey results from Bloomberg last month support this as they found 3% of respondents want to invest in Cryptos.

“Bitcoin is the preferred investment choice among check recipients. It comprises nearly 60% of the incremental spend, which may imply $25 billion of incremental spend on Bitcoin from stimulus checks,” wrote Mizuho analysts. “This represents 2-3% of Bitcoin’s current $1.1 trillion market cap.”

You could have $10K if you invested your first stimulus check in last April. What if you invested your $600 second stimulus check in January? You would have made a 93% return.

I am very bullish on Cryptocurrencies and I look at them as asynchronous bets. I ran a cryptocurrency mining company between 2017 to 2019. I am currently heavily invested in over 50 different coins including Bitcoin, Ethereal and Litecoin.

If you are interested in learning more about this, feel free to email me at alpesh@wealthmatrs.com.

Why I am bullish on cryptocurrencies

Korean Crypto trading volume has surpassed the national stock market volume

Kessler Collection will start accepting Bitcoin as payment

Visa is planning to enable cryptocurrency transactions

Morgan Stanley introduces Bitcoin investing for millionaire clients

You Can Still Avoid Bitcoin, but You’ll Pay the Price in the Future

Bitcoin Depot Launches More than 100 New Bitcoin ATMs, Surpassing 2,000 Kiosks Worldwide