Mortgage Updates for September 2020

We are only three months away towards the end of the year 2020. It feels like the year has gone by so fast because of the coronavirus pandemic. The world’s economy has stumbled though everyone is slowly trying to get back up. In the previous articles, we discussed COVID-19’s impact on real estate investing, investor’s minds, and real estate lending. Today, let us talk about September 2020 mortgage updates. How is the housing market doing in the last quarter of 2020?

Housing Market Update

In the first quarter of the year, the economy hit the rock-bottom and it was put on pause in an effort to combat COVID-19. As a result, lots of real estates transactions were put on hold as well. As lockdowns and home quarantines were lifted, home sales, housing prices, and applications slowly get back in business. In fact, the growth in demand and sales in the past two months are all recovered.

Experts have recorded the highest national price increase. For the first time in history, the national median sales price exceeded the $300,00 level mark. In July 2020, the national median price in all housing types is $304,100. It is an 8.5% increase from $280,400 last year of the same month. July’s national price increase marks 101 straight months of year-over-year gains. This is based on the National Association of Realtor’s (NAR) home prices data.

In August, a boost of 3% in the sales of existing homes were seen after the price increase in the previous months. This improvement was due to low mortgage rates. When the rates are low, buyers have more opportunities to get more for their money when buying a home. It motivates the buyer’s interests, thus, driving the demand for housing further.

September 2020 Mortgage Updates

Just this year, the mortgage rates have hit a new record low no less than nine times. There are two types of home loans –- the conventional and non-conventional mortgage. A conventional mortgage is a home loan that is not backed by a government agency. Meanwhile, a non-conventional mortgage is a government-backed loan. Usually, they are insured by the Federal Housing Administration (FHA). VA-backed loans, or other types of financing like the Rural Housing Service.

Conventional mortgages need to meet a down payment and income requirements established by the Government-sponsored enterprise such as Fannie Mae and Freddie Mac. They typically conform to the loan limits set by the Federal Housing Finance Administration (FHFA). Conventional loan, on the other hand, allows borrowers to put at least 20 percent down and it does not have to be from private mortgage insurance. Hence, they put lower down payments compared when getting a conventional mortgage.

Let us discuss September 2020 mortgage updates according to loan type.

Conventional Mortgage Update

According to Freddie Mac’s report last Thursday, the average 30-year fixed mortgage rate home loan rose from 2.85% to 2.90% a week ago. When compared last year, the average rate was at 3.64%. On the other hand, the 15-year fixed mortgage also rose from 2.40% to 2.35% from last week.

The low-interest rates might have made the housing demand stronger, however, there is still a scarcity of housing supply. Based on NAR’s existing-home sales data, the completed transactions that include single-family homes, townhomes, condominiums, and co-ops, rose 2.4% from July to a seasonally-adjusted annual rate of 6.00 million in August. Sales rose year-over-year, up 10.5% from a year ago (5.43 million in August 2019). Although scarce inventory has been a problem for the past few years, the issue became worse due to the pandemic. The lack of inventory pushes the housing prices higher. NAR reported that the August median price of a single-family home is $315,000. It is an 11.7% difference from last year.

Non-Conventional Mortgage Update

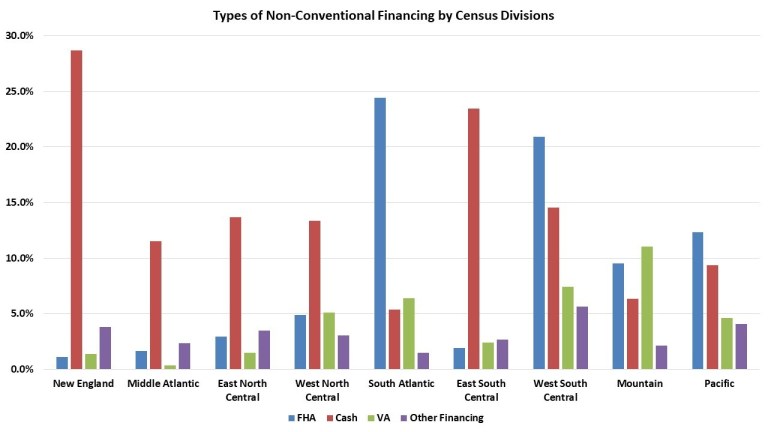

Non-conventional mortgages increased accordingly, from 28.6 percent to 35.0 percent. In 2019, the new home purchases were at 15% and rose to 19% this year. This means that buyers bought more new homes with non-conventional financing. The share of cash purchases, the second most prevalent form of non-conventional financing, was at 11.0 percent nationwide in 2019. VA-backed loans accounted for 6.0 percent and other financing types have a 3.0 percent market share, says MortgageNewsDaily.

Mortgage Applications Updates

Another interesting item in September 2020 mortgage updates is the number of mortgage applications. In the latest Mortgage Bank Association’s weekly survey, the data shows that mortgage applications increased 6.8 percent from the last week.

“Mortgage applications activity remained strong last week, even as the 30-year fixed-rate mortgage and 15-year fixed-rate mortgage increased to their highest levels since late August. Purchase applications were up over 25 percent from a year ago, and the demand for higher-balance loans pushed the average purchase loan size to another record high. The strong interest in homebuying observed this summer has carried over to the fall,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Despite the uptick in rates, refinance applications increased around 9 percent and were almost 86 percent higher than last year. Both conventional and government refinance activity, and in particular, FHA refinances, picked up last week.” He added.

What does this mean?

In the past months, mortgage applications declined because people are not seeing themselves buying a new home. Simply because they could no longer afford buying homes due to the impact of the pandemic. The increase in mortgage applications implies that the housing market is waking back up. It shows a positive sign.

Other Mortgage Applications Updates

Here are other detailed information on September 2020 mortgage updates:

- The Federal Housing Administration’s share of mortgage apps rose to 10.5% from 10.3% compared last week.

- The share of applications on the Department of Veterans Affairs declined from 13.8% to 13.3%.

- The Department of Agriculture’s share of total applications increased from 0.4% to 0.5%.

- Mortgage interest rates for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) fell to 3.43% from 3.45% the week before.

- The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $510,400) fell to 3.72% from 3.81%.

- The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased from 3.33% to 3.39%.

- The average contract interest rate for 15-year fixed-rate mortgages decreased from 3.03% to 2.98%.

- The average contract interest rate for 5/1 ARMs remained at 3.29%.

Conclusion

The September 2020 mortgage updates simply show that the housing market is still hot despite the pandemic. Homebuyers are now getting more confident that they can afford to buy homes despite unemployment.